Browsing the EB5 Visa Process: A Detailed Guide for UK Citizens

The EB5 Visa process offers a path to united state residency for UK citizens through investment. Understanding the actions entailed is crucial for a successful application. From figuring out the appropriate financial investment alternative to steering through the complexities of documentation, each stage has its obstacles. As individuals start this journey, they have to be mindful of the qualification needs and the possible obstacles that might emerge. What approaches can ensure a smoother changeover into this procedure?

Comprehending the EB5 Visa Program

What makes the EB5 Visa Program an attractive option for financiers? This program uses a pathway to united state long-term residency through investment in job-creating ventures. By investing a minimum of $900,000 in targeted work locations or $1 - EB5 Visa.8 million in other regions, foreign financiers can safeguard a copyright for themselves and their immediate household. The EB5 Visa is appealing because of its dual benefits: potential return on investment and the chance for a steady life in the USA. In addition, the program enables financiers to join a prospering economic situation and add to job creation, improving their charm as liable international residents. The prospect of a streamlined migration process additionally solidifies the program's appearance, making it an engaging selection for many

Eligibility Needs for UK Citizens

To get approved for the EB5 visa, UK people have to satisfy particular financial investment amount standards, normally calling for a minimum financial investment in a united state company. Furthermore, candidates must demonstrate the lawful source of their funds to assure conformity with migration laws. Recognizing these demands is necessary for an effective application process.

Investment Amount Standard

Comprehending the financial investment amount criteria is important for UK citizens seeking to get involved in the EB5 visa program. The minimum financial investment required typically stands at $1 million in a new business. However, this quantity is reduced to $500,000 if the financial investment is made in a targeted employment area (TEA), which is defined by high joblessness or reduced population thickness (EB5 Visa For UK Citizens). This difference is important, as it provides a possibility for capitalists to add to economically troubled regions while additionally satisfying visa requirements. It is essential for potential investors to be knowledgeable about these financial limits, as they directly affect eligibility and the total success of their EB5 application process. Mindful consideration of the financial investment amount can considerably affect the outcome

Source of Funds

Investment Options: Direct vs. Regional Facility

Guiding through the investment landscape of the EB5 visa program discloses two main options for UK citizens: direct financial investments and local center projects. Direct financial investments entail purchasing a brand-new business, where the investor normally takes an active role in business procedures. This route may use higher returns however needs a lot more hands-on monitoring and an extensive understanding of the service landscape.

In comparison, local facility tasks permit financiers to add to pre-approved entities that handle several EB5 financial investments. This alternative usually calls for much less participation from the capitalist and can give a much more easy investment experience. Both opportunities have unique benefits and difficulties, requiring careful factor to consider based upon individual economic objectives and risk resistance.

The Minimum Financial Investment Amount

The EB5 visa process requires a minimal financial investment amount that varies depending upon the picked investment route. For those going with a Regional Center, the conventional investment threshold is generally higher due to the nature of these tasks (EB5 Visa For UK Citizens). Investor Visa. Comprehending these economic requirements is necessary for UK people seeking to browse the EB5 program properly

Investment Amount Introduction

Understanding the monetary demands of the EB5 visa procedure is vital for UK people considering this immigration pathway. The EB5 visa program usually mandates a minimal financial investment amount of $1 million in a brand-new business. This quantity can be lowered to $500,000 if the investment is made in a targeted employment area (TEA), which is characterized by high unemployment or rural location. These financial investment limits are important for qualifying for the visa, as they directly influence the eligibility of prospects. Possible capitalists have to carefully assess their financial capabilities and guarantee compliance with the recognized demands. This investment not only opens the door to united state residency yet likewise adds to financial development and task development within the nation.

Regional Facility Alternative

While discovering the EB5 visa alternatives, capitalists might locate the Regional Facility program especially appealing as a result of its reduced minimal investment requirement. As of October 2023, the minimum financial investment quantity for the Regional Facility choice is set at $800,000, significantly much less than the $1,050,000 required for direct investments in brand-new business ventures. This minimized threshold enables much more investors to participate, particularly those looking for a more easy financial investment approach. The Regional Facility program likewise provides the benefit of job production with pooled financial investments in larger projects, which can bring about a smoother path to permanent residency. For UK people considering the EB5 visa, the Regional Facility option provides a compelling financial reward alongside prospective development possibilities.

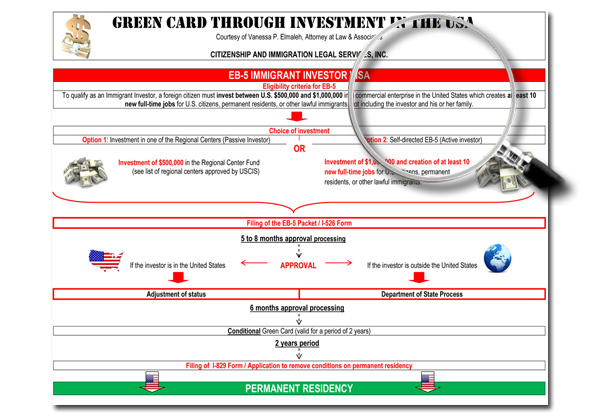

The Application Process: Step-by-Step

Maneuvering the EB5 visa process needs cautious interest to detail, as each action is vital for success. First, applicants must choose either a straight investment or a local facility alternative, depending on their investment method. Next, they need to collect needed paperwork, consisting of proof of funds and a considerable company plan. When prepared, applicants send Form I-526, the Immigrant Request by Alien Financier, to the USA Citizenship and Migration Provider (USCIS) After authorization, candidates can use for a visa at a united state consular office or readjust their standing if currently in the united state Upon arrival, financiers have to keep their financial investment for a marked duration, generally two years, to fulfill the EB5 requirements.

Common Challenges and How to Get rid of Them

Maintaining Your EB5 Condition and Course to Citizenship

Effectively keeping EB5 standing is important for financiers intending to attain irreversible residency in the USA. To maintain this status, investors should ensure that their funding financial investment remains in danger which the financial investment develops the needed number of tasks within the specified timeframe. Regular interaction with the local center or job supervisors is vital to stay educated concerning conformity and efficiency metrics.

In addition, investors must file Kind I-829, the Application by Business Owner to Get Rid Of Problems, within the 90-day window before the two-year anniversary of getting conditional residency. This application calls for documents showing that all financial investment problems have been satisfied. Lastly, keeping a clean lawful document and sticking to U.S. laws will significantly improve the path to eventual citizenship.

Frequently Asked Inquiries

For how long Does the EB5 Visa Process Generally Take?

The EB5 visa procedure usually takes around 12 to 24 months. Nonetheless, elements such as processing times at united state Citizenship and Immigration Providers and the volume of applications can create variations in this duration.

Can Family Members Join Me on My EB5 Visa?

Yes, family members can accompany a private on an EB5 visa. This includes spouses and children under 21, enabling them to get irreversible residency along with the main candidate during the visa process.

What Happens if My Investment Fails?

If the investment fails, the person might shed the spent funding and potentially jeopardize their visa status. They must talk to a migration attorney to explore options for maintaining residency or attending to the investment loss.

Exist Age Restrictions for Dependents Using With Me?

There are age restrictions for dependents using with the major applicant. Just unmarried youngsters under 21 years old can certify as dependents, implying those over this more information age must apply independently for their own visas.

Can I Work in the U.S. With an EB5 Visa?

A specific holding an EB-5 visa is permitted to operate in the USA. This visa grants them the capability to take part in job opportunity, as it results in irreversible residency status upon fulfilling the requirements.

To certify for the EB5 visa, UK people must satisfy certain financial investment amount criteria, typically needing a minimal financial investment in a United state business. Steering through the financial investment landscape of the EB5 visa program discloses two primary options for UK residents: direct financial investments and local facility jobs. The EB5 visa procedure calls for a minimal financial investment quantity that differs depending on the chosen investment route - EB5 Visa. As of October 2023, the minimal investment amount for the Regional Facility option is established at $800,000, considerably much less than the $1,050,000 needed for straight financial investments in new commercial enterprises. To preserve this standing, capitalists should assure that their funding financial investment stays at threat and that the investment creates the necessary number of tasks within the specified duration